OLC Testifies on HB 1

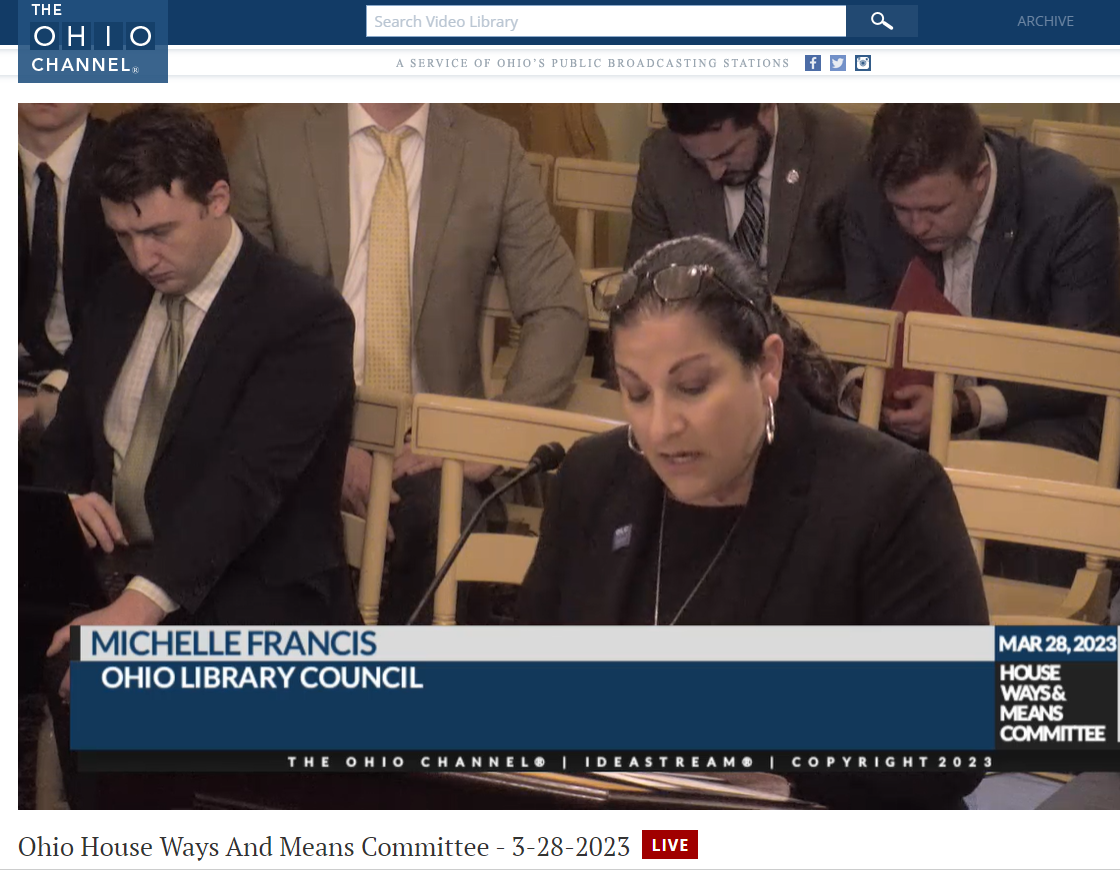

OLC’s Executive Director Michelle Francis testifies in opposition to HB 1, in front of the Ohio House Ways and Means Committee.

Ohio House Bill (HB) 1 would enact sweeping changes to property taxation and income tax rates. On March 28, OLC’s Executive Director Michelle Francis testified in opposition to HB 1 in front of the House Ways and Means Committee. She told lawmakers that this legislation, as introduced, would have a devastating impact on public libraries.

The first impact HB 1 would have on public libraries is caused by proposed changes to the state income tax. According to the Legislative Service Commission (LSC) Fiscal Note for HB 1, public libraries are estimated to lose more than $74 million from the Public Library Fund (PLF) over the biennium. Francis said that in order to make up the difference in the estimated loss to the Public Library Fund (PLF), the PLF percentage would need to be adjusted to at least 2.0% of the General Revenue Fund. Currently the PLF is set at 1.7%.

Francis also explained that public libraries would be impacted by the proposed changes to local property taxes. HB 1 proposes to eliminate the 10% property tax rollback on Class 1 property, reduce the real property assessment rates from 35% to 31.5% on both Class 1 & 2 property, and includes a gross domestic product deflator formula for future reductions in the property assessment percentage. In this regard, the LSC is estimating the loss to local governments, including public libraries, to begin at $239 million in Tax Year 2024. In addition, Francis said that public libraries currently receive about $40 million from the rollback on Class 1 property. Eleven public libraries provided additional opponent written testimony on HB 1. Transcripts and a video recording of the committee hearing are available at libraryfunding.olc.org.

At this time, it’s unclear what the next steps are for HB 1 and if additional hearings will be held. It’s likely that any proposed tax cuts will be included in upcoming revisions to the budget legislation through HB 33. Watch for more updates.